From left: Me, Rey Gan (CTO / Director, Mobile Wallet) & Michael

1. Listen to Everybody. This is probably a controversial one to start off with, because there are so many jokers and dreamers out there who have zero chance of getting their issue, or that of their clients issue (in the case of brokers) off the ground.

Talking to everyone will also allow you to get a feel for who is good in the space and who isn't when dealing with brokers. I read an excellent quote on the net the other day "Even a blind squirrel sometimes finds a nut in the forest". This is a good quote to bear in mind when you are dealing with brokers you don't rate. Sooner or later they may stumble on something interesting.

2. Read the prospectus. Obvious? Most people don't get beyond the nice blurb in the first 15 pages.

The best places to look are 'Risk Factors' and 'Statutory and General Information'. Risk factors will, more often than not, be generic but may bring up something for further research.

The 'Stats and Gens' should give you a better idea of the company itself. Look at the history section. This should tell you how many shares are authorised (meaning how many shares they could issue) and the issued share capital (meaning how many shares they have issued). The issued share capital will tell you, for example, that there have been 10,000,000 shares issued and they are fully paid up.

Check out and 'loans from directors'. There simply shouldn't be any. I would be hugely suspicious if there were any outstanding loans because why would the directors be asking you to invest at a certain price but would not be prepared to capitalise their loans? They either believe in the company or they don't. If they haven't converted their loans it would be a pass for me.

Check out if any director has been involved in companies liquidated previously. This is point that I argue with people on. Some see failed companies as a bad thing, I believe that people grow by learning from their mistakes, don't write the company or director off because he has made errors, but do look at the circumstances of these errors.

Check out how much management owns of the shares. If its above 75% after the offer, be careful, there are a lot of things that can be done by someone holding 75% of the shares that may be against the interest of shareholders. If it is less than 30%, ask yourself whether there is enough to lose or gain from the success or failure of the company for the directors. I like to see between 40%-60% (obviously depending on the size of the company and the stage of investment).

Check out other shareholders. If you see Warren Buffet in there, chances are it is a good one to look at.

3. Do your Research. An obvious one, but a crucial one. Check out the sector, the management, the investors, the concept, the product, the accounts… everything. If you find that the information you come up with is beyond your knowledge then ask someone who knows about such things. If it is still beyond you and you cannot rely on other known investors to have done the research, pass.

4. Make a Move, but don't Over Do It. By all means, if you think you have discovered the next Google and want to invest your life savings, go ahead. But don't complain if it doesn't work out.

So next time, you hear your financial planners or friends telling you that theirs are the Best Investment opportunities available, do evaluate for yourself.

So next time, you hear your financial planners or friends telling you that theirs are the Best Investment opportunities available, do evaluate for yourself.

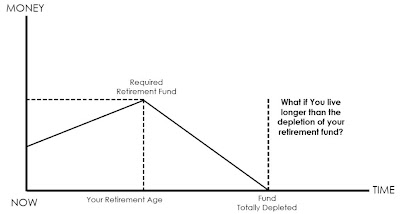

This is the typical insurance model where you work and save for your whole lifetime till your retirement age. And when you retire, you have to downsize yourself (whether is it your house, your car, and all your daily expenses etc) and your equity level starts to fall. But when if you out-live your retirement fund?

This is the typical insurance model where you work and save for your whole lifetime till your retirement age. And when you retire, you have to downsize yourself (whether is it your house, your car, and all your daily expenses etc) and your equity level starts to fall. But when if you out-live your retirement fund? What you see here is the revised Capital Preservation Model. A typical Capital Preservation Model is one where you see your money continue to grow (i.e. positive gradient) after retirement.

What you see here is the revised Capital Preservation Model. A typical Capital Preservation Model is one where you see your money continue to grow (i.e. positive gradient) after retirement.OCTAGON GLOBAL ALLIANCES dedicates to provide a systematic platform for individuals to embark on a financial journey towards a better life and create financial abundance for themselves. We do this through ongoing research and resources development on the global business and financial environment.

VISION

To create the leading business network and provide individuals the financial advantages to achieve real-world financial success with the best business, trading and investment opportunities regionally and globally.