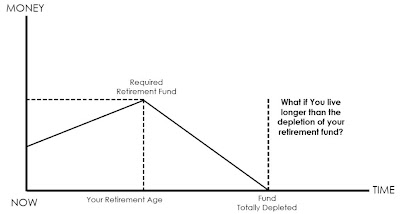

This is the typical insurance model where you work and save for your whole lifetime till your retirement age. And when you retire, you have to downsize yourself (whether is it your house, your car, and all your daily expenses etc) and your equity level starts to fall. But when if you out-live your retirement fund?

This is the typical insurance model where you work and save for your whole lifetime till your retirement age. And when you retire, you have to downsize yourself (whether is it your house, your car, and all your daily expenses etc) and your equity level starts to fall. But when if you out-live your retirement fund?At OCTAGON, I advocate people to look into EARLY RETIREMENT PLANNING (ERP) with us. With ERP, you don't have to worry when your retirement funds will run out and you'll be able to retire earlier with a bigger pools of assets generating ongoing passive income for you.

What you see here is the revised Capital Preservation Model. A typical Capital Preservation Model is one where you see your money continue to grow (i.e. positive gradient) after retirement.

What you see here is the revised Capital Preservation Model. A typical Capital Preservation Model is one where you see your money continue to grow (i.e. positive gradient) after retirement.So what you are seeing here is that you don't have to downsize yourself. I called it the Early Retirement Model. In fact, we believe that when you save and invest in assets (like properties etc) till your retirement, this is the time you should spend on yourself and your family.

Go tour around the world (this is the dream of many people around), do something you never do before (remember you are still young compared to the typical retired guy next door!), buy a bigger apartment (another asset for you again), drive a better car etc... You deserve because you PLAN!

No comments:

Post a Comment